Author: icebergfinanza Finanza.com Blog Network Posts

La scorsa settimana abbiamo condiviso la perla dei fondi pensione e delle dinamiche nascoste dietro la riforma fiscale di Trump, oggi invece una piccola sintesi interamente tratta da Bloomberg…

Dollar Hoarding Is a Year-End Risk for Markets

In the waning weeks of 1999, there was widespread concern that software programs might not recognize the number 2000 once the calendar turned from December to January, crippling computers and creating mass chaos in what was referred to as “Y2K.” We now know that didn’t happen, but those anxieties have a legacy in financial markets.

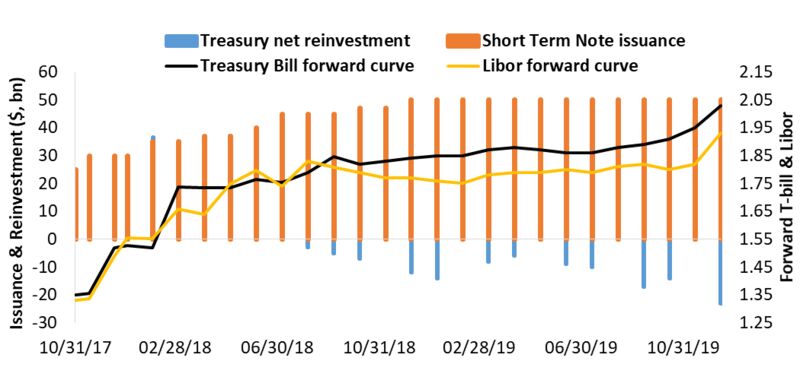

Ever since then, financial institutions and companies take extra efforts to fund their operations over the year end in what has become known as the “balance sheet effect.” This generally entails the hoarding of dollars, creating a squeeze in demand for greenbacks that can have a negative impact on markets and tighten financial conditions. The effect may be more pronounced this year as tensions around the U.S. debt ceiling and the competing Republican tax bills in Congress come together in a way that could cause the dollar to appreciate in value. (…) A rising currency is normally not a bad thing, but the problem now is that it could exacerbate some negative trends in the markets. For example, there’s the potential for a strong dollar to drive up short-term interest rates even further. Also, credit spreads may widen as dollar rates rise, such as during the 2008 financial crisis when the London interbank offered rate, or Libor, skyrocketed.

A dire il vero, prosegue l’articolo, sembra improbabile che si verifichi una crisi di finanziamento in dollari su vasta scala, ma tutti gli ingredienti sono al posto giusto, portano verso una certa scarsità, mentre il deficit del bilancio federale aumenta e la Federal Reserve continua a ridurre il suo bilancio. Suppongo che si sono già tutti dimenticati dell’appuntamento con il tetto del debito a metà dicembre, ma certo tanto non succederà nulla.

Fonte: Bloomberg

In termini creditizi, ripensiamo alla fine del 2015 e all’inizio del 2016, quando i mercati dei titoli investment grade e obbligazionari ad alto rendimento hanno subito uno stress elevato a causa della speculazione che un crollo dei prezzi del petrolio avrebbe innescato un’ondata di inadempienze nel settore energetico ad alta leva.

Quello che accadde allora fu che il dollaro si rafforzò, contribuendo ad un rallentamento dell’economia. A febbraio 2016, i banchieri centrali si riunirono a Shanghai per affrontare la forza del dollaro, che stava facendo pressione sui mercati del credito a livello globale, in particolare quelli dei mercati emergenti che hanno prestiti di grandi dimensioni denominati in dollari.

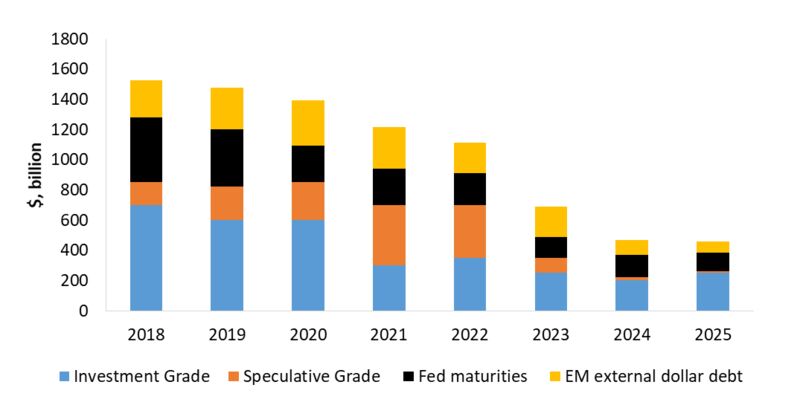

La domanda di dollari potrebbe aumentare, dal momento che i mutuatari cercano i biglietti verdi per poter rimborsare 1.5 trilioni di debiti denominati in dollari in scadenza l’anno prossimo.

Fonte: S & P, Moody’s e New York Federal Reserve

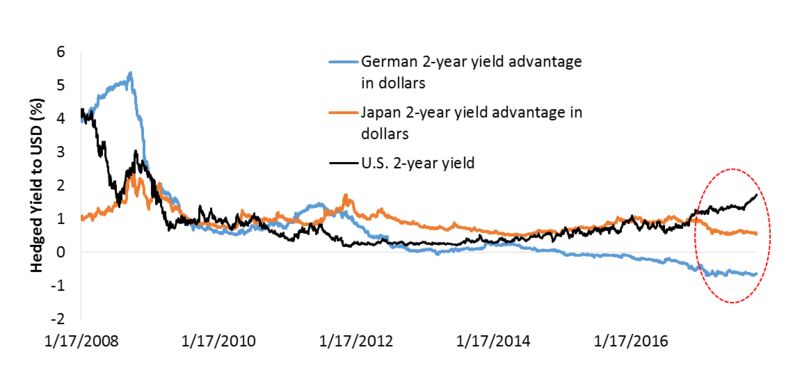

La domanda di dollari continua ad arrivare dagli investitori europei e giapponesi che cercano rendimenti più elevati rispetto a quelli che possono ottenere nei loro mercati nazionali.

Fonte: Bloomberg.

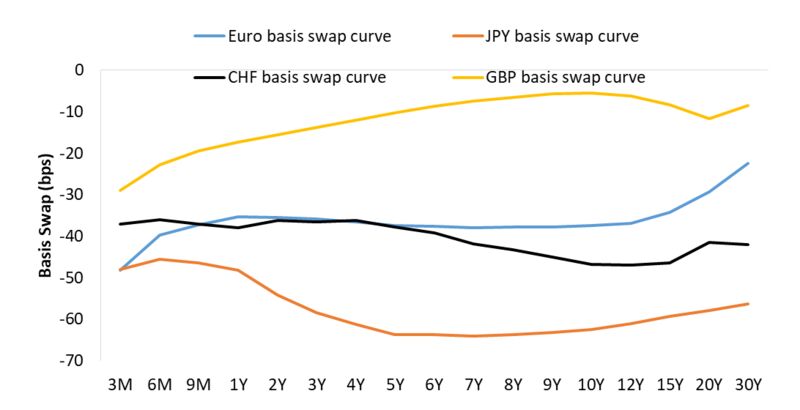

Eecentemente, come riporta l’articolo ma per noi non è una novità, le curve sui cambi in valuta in euro, yen e franchi svizzeri sono diventate negative, suggerendo una crescente domanda di dollari, poiché le società di quei paesi cercano la valuta statunitense a fine anno.

Base Swap Swap

Fonte: Bloomberg

Il resto lo conoscete, non serve aggiungere altro!

VN:F [1.9.20_1166]

VN:F [1.9.20_1166]

DOLLAR HOARDING IS A YEAR END-RISK FOR MARKETS.,